Voluntary Car Insurance

Discover the best voluntary car insurance solutions in Thailand with Roojai. We offer comprehensive, customisable coverage options designed to meet your unique needs. With quick online quotes, competitive premiums, and exceptional customer service, Roojai ensures you drive with confidence and peace of mind.

Compare, save, and secure your car insurance with Roojai today!

What is voluntary car insurance in Thailand?

Voluntary car insurance in Thailand is an optional insurance policy that provides additional coverage beyond the compulsory insurance (Por Ror Bor) required by law. This type of insurance offers higher coverage limits and more comprehensive protection, including coverage for damages to your vehicle, third-party liabilities, theft, fire, and natural disasters. By opting for voluntary car insurance, you can customise your policy to suit your needs better and reduce your financial risk in case of an accident or other unforeseen events.

Types of voluntary car insurance & coverage in Thailand

In Thailand, voluntary car insurance is categorised into several types, each offering different levels of coverage:

Type 1 car insurance

Type 1 car insurance is the most comprehensive option, covering accidents with or without a third party, third-party liability for damages or injuries caused by your car, and windscreen damage, whether it needs repair or replacement. It also includes coverage for non-collision incidents such as theft, fire, and flooding. Additionally, it provides bail bond, personal accident, and medical expenses.

Ideal for:

- New cars (up to 5 years old)

- New drivers

- Frequent and long-distance drivers

Type 2+ car insurance

This insurance covers road accidents involving a third-party and third-party liability for property damage and bodily injury. It also includes coverage for non-collision events like theft, fire, and flooding, along with bail bonds, personal accidents, and medical expenses.

Ideal for:

- Regularly used cars (up to 7 years old)

- Cars parked in risky areas

Type 3+ car insurance

This insurance covers accidents involving a third-party regardless of fault, and third-party liability for damages or injuries caused by your car. It also includes bail bond, personal accident, and medical expenses.

Ideal for:

- Frequently used cars

- Cars over 7 years old

Type 2 car insurance

Type 2 car insurance covers third-party liability for property damage and bodily injury, as well as non-collision events like theft and fire. It also includes bail bond, personal accident, and medical expenses.

Ideal for:

- Vehicles that are at moderate risk of theft or fire but not frequently involved in accidents.

Type 3 car insurance

The most basic voluntary insurance, covering third-party liability for damages or injuries caused by your car, along with bail bonds, personal accident, and medical expenses.

Ideal for:

- Experienced drivers with older vehicles who want the most affordable option.

Electric vehicle (EV) insurance

EV car insurance is designed for electric vehicles, considering their unique features and repair costs. It covers accidents, third-party liability, windscreen damage, theft, fire, flooding, bail bond, personal accident, medical expenses, as well as EV battery and wall charger coverage.

Ideal for:

- Owners of electric vehicles

- Drivers looking for comprehensive coverage tailored to EVs

| Coverage details | Type 1 | Type 2+ | Type 3+ | Type 2 | Type 3 | EV Insurance* |

|---|---|---|---|---|---|---|

| Car damages without a third-party | ||||||

| Car damages with a third-party | ||||||

| Damage to windshield | ||||||

| 24-hour towing service | ||||||

| Theft | ||||||

| Fire | ||||||

| Flood | ||||||

| Natural disasters | ||||||

| Third-party property damages | ||||||

| Third-party bodily injuries and loss of life | ||||||

| Medical expenses | ||||||

| Personal accident coverage | ||||||

| Bail bond for a drivers | ||||||

| Wall charger | ||||||

| Battery replacement in case of accident | ||||||

| Loss of vital organ |

Can be purchased

*Only applicable to EV car insurance type 1.

Customisable voluntary car insurance coverage options

In addition to selecting the appropriate sum insured for each type of car insurance, Roojai customers can customise their policies further to suit their individual needs and preferences better. Here are some of the key insurance coverage options available:

Adjustable excess options

Choose the amount you are willing to pay out-of-pocket in the event of a claim. A higher excess can lower your premium, while a lower excess provides greater financial protection as it reduces your immediate financial burden if an accident or damage occurs.

Personal accident coverage

Adjust the coverage amount for personal accidents to ensure adequate financial protection for you and your passengers in case of injuries or death resulting from an accident.

Medical expense coverage

Choose the level of medical expense coverage that best matches your healthcare needs, covering costs for medical treatments, hospital stays, and other related expenses.

Repair garage plans

Preferred repair garages

Opt for repairs at Roojai's network of preferred garages, ensuring high-quality service and genuine parts at lower costs. These repairs come with a 12-month warranty, with top-notch service and affordable premiums.

Dealer repair garages

Select any dealer or preferred repair garage from our network for added convenience and trust in the service provider. Repairs at these garages also include a 12-month warranty. If you choose another garage not listed in the Roojai network, please contact us 24 hours in advance to make arrangements.

How much does voluntary car insurance cost in Thailand?

The cost for car insurance in Thailand can vary, as many factors can influence the premium rates you receive. These factors include driving experience, claim history, vehicle model, age, purpose of use, and the type of insurance plan you choose.

Average voluntary car insurance premiums in Thailand

| Car Insurance Type | Average Premiums |

|---|---|

| Type 1 (Comprehensive) | THB 11,821 |

| Type 2+ | THB 4,464 |

| Type 3+ | THB 5,886 |

| Type 2 | THB 4,141 |

| Type 3 | THB 5,143 |

*EV premiums excluded

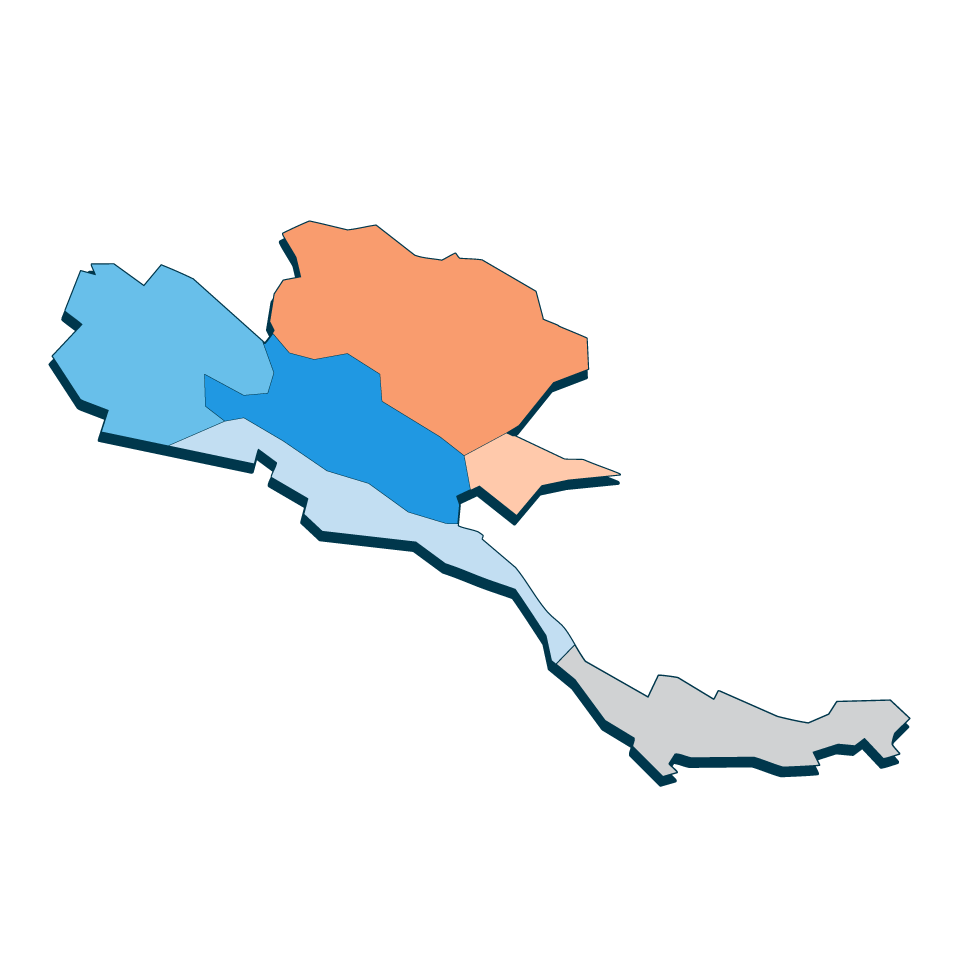

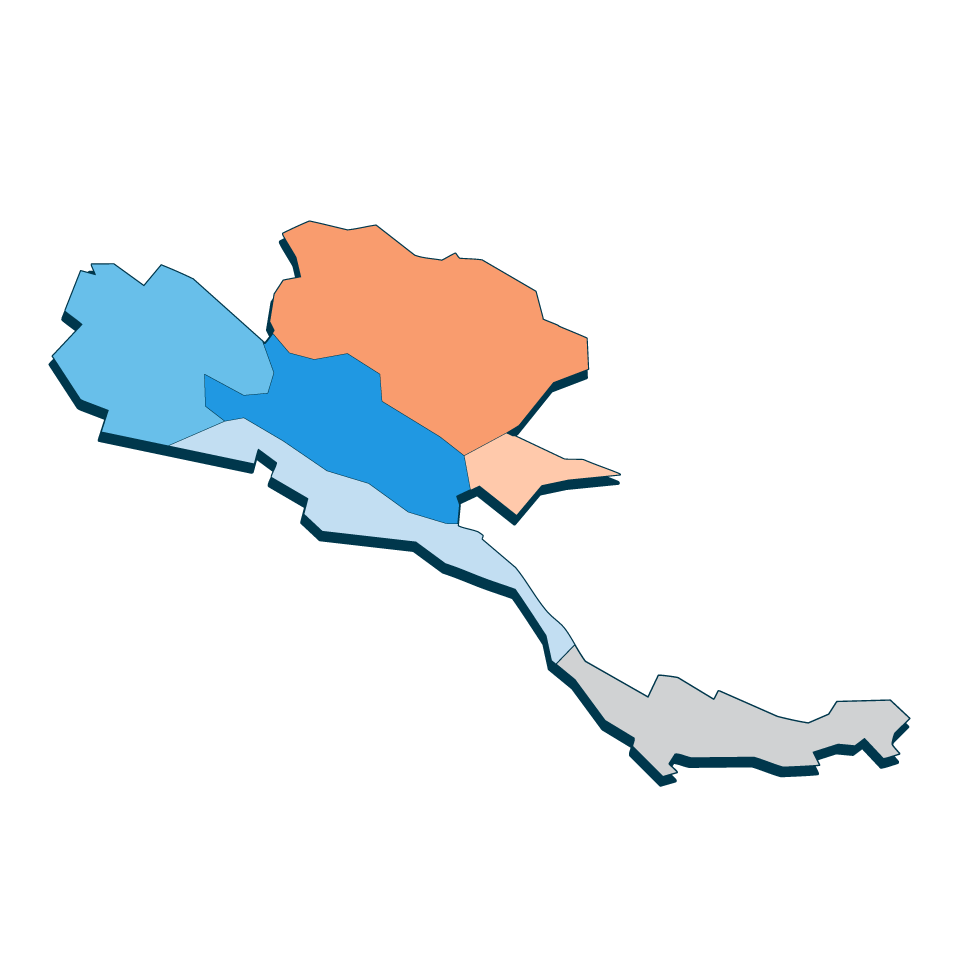

Average full-coverage car insurance premiums by region

Northern

THB 11,068

Central

THB 12,623

Northeastern

THB 11,750

Eastern

THB 12,191

Western

THB 11,977

Southern

THB 12,414

| Central | THB 12,623 |

| Eastern | THB 12,191 |

| Northeastern | THB 11,750 |

| Northern | THB 11,068 |

| Southern | THB 12,414 |

| Western | THB 11,977 |

What is excess in voluntary car insurance?

Car insurance excess is the amount a driver pays out-of-pocket when making a claim for vehicle repairs after an accident. Here's a concise breakdown:

- Small damages: If the repair cost is less than the excess, the driver pays for the repairs themselves, avoiding an insurance claim and preserving their good driver history.

- Large damages: For higher repair costs, the driver pays the excess, and the insurer covers the remaining amount up to the policy limit.

- Voluntary excess: Choosing a higher excess can lower the insurance premium, as it reduces the insurer's risk for minor damages.

- No-fault claims: If the driver is not at fault, the excess does not apply.

Example of how excess works

Let's say you have a car insurance policy with an excess of THB 5,000. If you get into an accident and the repair costs are THB 20,000, here's how the excess would apply:

- Total repair cost: THB 20,000

- Your excess: THB 5,000

You would be responsible for paying the first THB 5,000 of the repair bill. After you pay this amount, your insurer will cover the remaining THB 15,000.

In the case that a third-party is at fault and the repair costs are THB 40,000, the insurance company would pay the entire amount, and you would not have to pay anything.

Tips for buying voluntary car insurance in Thailand

- Choose the right plan: Review different car insurance rates and select the one that fits your driving habits. If you don't live in a high-risk area for theft or flooding, you can choose type 3+ policy to save on premiums.

- Customise your quote: Lower your premium by increasing the excess amount or selecting only one main driver.

- Opt for an e-policy: Get your policy documents instantly via email with the e-policy option.

- Download the Roojai Mobile App: Make instant claims, upload inspection photos, check policy details, and use your Roojai Rewards.

Frequently asked questions about voluntary car insurance in Thailand

How do I choose the right type of voluntary car insurance for my needs?

Consider factors such as the age and value of your car, your driving habits, and your budget. Type 1 insurance offers the most comprehensive coverage, while Type 3 is the most basic and affordable.

What is typically not covered by voluntary car insurance in Thailand?

Voluntary car insurance typically does not cover the following situations:

- Driving outside the coverage area (e.g. outside Thailand)

- Racing or high-risk activities

- Using a personal vehicle for commercial purposes

- Driving under the influence

- Driving without a valid licence

These exclusions are important to understand so you can ensure that your claims are processed smoothly.

Who is Roojai suitable for?

Roojai is an excellent choice for conscientious car drivers looking to purchase car insurance while saving both time and money. We are dedicated to assisting safe and responsible drivers in finding the perfect vehicle policy. If you are an existing customer wishing to renew your car insurance with Roojai, you can conveniently do so online through MyAccount or the Roojai Mobile App.

What is the process for getting a voluntary car insurance quote with Roojai?

You can get a quote online by entering your vehicle and personal details. The process is quick, easy, and free, allowing you to compare different coverage options.

How long is my car insurance quote valid for?

Your car insurance quote is valid for 30 days from the date it was created. You'll receive your quote via email.

What are the requirements to buy voluntary car insurance with Roojai?

To purchase car insurance with Roojai, you need to meet the following criteria:

- Drivers must be between 20 and 75 years old.

- A valid driving licence is required. In some cases, the licence must have been held for more than 2 years.

- No previous history of having your driving license revoked.

- No more than 3 at-fault insurance claims in the past 12 months.

- The vehicle must be registered in Thailand.

Find out more on how to buy car insurance with Roojai.

Why buy voluntary car insurance with Roojai?

Roojai offers affordable premiums with superior coverage tailored to your needs. Choose from flexible plans and customise your policy with additional services such as compulsory insurance or car replacement.

We calculate your premiums fairly based on your vehicle, driving history, and experience. Our top-rated service is proven by our 4.9/5 customer satisfaction score and 4.7/5 claim satisfaction score, making us the best car insurance in Thailand.

- No contact information needed: Get your quote online without submitting your email or phone number.

- Good driver discounts: Save up to 30% on your premium if you have a good driving record.

- Flexible payment options: Pay easily, including through 10 monthly instalments.

- Convenient claims: Make video claims using the Roojai Mobile App.

- Exceptional customer support: Enjoy excellent service and claims support, as proven by real customer experiences.

- Repair warranty: Benefit from a 12-month warranty on car repairs at Roojai network garages.

- Quick response: We guarantee arrival at the accident scene within 30 minutes.

- Rewards program: Refer friends, collect, and redeem Roojai Rewards.

- Fast policy delivery: Receive your policy schedule within 7-14 working days or instantly with an e-policy.

- Easy contact: Reach us anytime by phone, website, or mobile app.

How can I pay for my voluntary car insurance policy with Roojai?

You can pay using a credit or debit card, PromptPay, Line Pay, TrueMoney, or online banking. It's convenient to buy or renew car insurance online 24/7.

Purchasing your car policy is quick and easy, taking just 5 minutes. Simply check your car insurance quote online, customise your coverage, plan, pay, and wait for our email confirmation.

Learn more about your payment options.

We will send your documents within 7-14 working days, or instantly if you choose an e-policy. In some cases, we may require an in-person, photograph, or video car inspection before coverage begins.

Will my insurance premium increase after making car insurance claims last year?

If you made a car insurance claim last year, your premium is likely to increase upon renewal. Here are some factors that can influence this:

- Insurance claim history: The number and severity of claims made.

- Previous insurance company policies: Different insurers have varying policies on premium adjustments after claims.

- Individual risk factors: Personal factors such as driving history and vehicle type.

However, many insurance companies, including Roojai, offer a "No Claims Bonus" (NCB) as a reward for policyholders who have not made any at-fault claims during the previous policy year.

What is a No Claims Bonus (NCB) for car insurance in Thailand?

The No Claims Bonus (NCB) is a discount provided by insurers to reward drivers who have not made any at-fault claims. The discount increases with each consecutive claim-free year:

- 20% discount on insurance premium renewal for 1 claim-free year

- 30% discount on insurance premium renewal for 2 claim-free years

- 40% discount on insurance premium renewal for 3 claim-free years

- 50% discount on insurance premium renewal for 4 claim-free years

What is the Roojai Mobile App and how can I use it with my voluntary car insurance policy?

The Roojai Mobile App is designed to make your life and road travel safer and more seamless. In case of a road accident or other emergencies, use the app to make a motor insurance claim via video call. The app also shares the real-time position of the Roojai surveyor as they drive to your location.

You can manage and renew your insurance policies, access your policy documents, refer friends, redeem Roojai rewards, and more through the app.

Wherever you are, Roojai is always by your side. Download the Roojai Mobile App now.

How to make a car insurance claim with Roojai?

Making a claim with Roojai is simple and convenient. You have several options:

- Use the Roojai Mobile App to make an instant claim through a video call.

- Call us on our claim hotline at 02-080-9194.

Find out how to file car insurance claims with Roojai.

How to contact Roojai?

- English customer service: 02-080-9196

- Report a car accident: 02-080-9194 or through Roojai Mobile App

- Send us a message: Reach out to us through our website or mobile app

Definitions

| Car insurance plans | Different types of motor insurance policies that provide various levels of coverage for your vehicle, including options for the sum insured. |

| Risk factor | Any characteristic that increases the likelihood of an insurance claim, like age, driving history, or vehicle type. |

| Non-collision incidents | Events causing vehicle damage without a collision, such as theft, vandalism, or fire. |

| Natural disasters | Severe natural events like floods, storms, or earthquakes that can damage vehicles. |

| Third-party liability | Coverage for damages or injuries you cause to others or their property while driving. |

Helpful car insurance guides

- How to pay less for your car insurance premiums

- What to do immediately after a car accident

- How long after a car accident can you file a claim?

Terms and Conditions apply.

Last Updated: 1st February 2025