Where to find the best cancer insurance?

When looking for a reliable cancer insurance policy, a good measure for quality cancer insurance is whether it provides;

High lump-sum coverage at almost any age (up to 60)

Coverage for any kind of cancer and at any stage

Does not continuously raise your insurance premium.

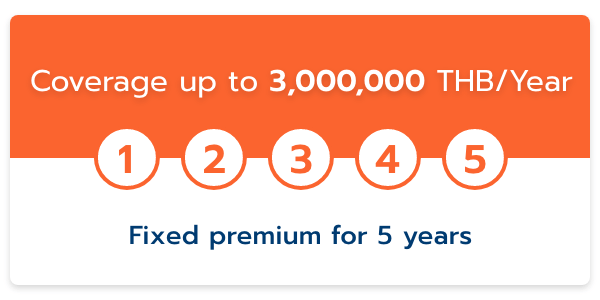

An insurance policy with Roojai will provide you all this and our promise of

A Fixed Cancer Insurance Premium for 5 years

Guaranteed Renewal Premium

When you renew your insurance policy, we guarantee a fixed premium for 5 years.

We will be providing continuous insurance coverage for your illness as specified in the policy if you make a payment:

- by the renewal due date

- before the renewal due date

- or within the grace period (30 days)

What are the benefits of a cancer insurance policy?

- The insured can be between ages 18-60 years old (the policy can be renewed until the age of 65)

- Apply easily by just answering a health questionnaire

- 5-year fixed premium

- Coverage at any stage of cancer when the illness is found and diagnosed

- Get lump sum up to 3,000,000 THB for any cancer diagnosed and up to 200,000 THB for skin cancer, depending on the selected plan

- Receive your policy documents within 2 weeks

- Premium payment is tax deductible up to 25,000 THB, depending on the taxation law

Cancer Insurance Plans with Roojai

| Value Plan | Standard Plan | Recommended Plan | Premium Plan | |

|---|---|---|---|---|

| Sum Insured | 500,000 | 1,000,000 | 2,000,000 | 3,000,000 |

| Skin Cancer Coverage | 50,000 | 100,000 | 200,000 | 300,000 |

| Starting Insurance Premium | 68 / month | 135 / month | 271 / month | 406 / month |

Easy and secure to pay online through credit/debit card.

Please read through the full plan details, assess your risk, and choose the right coverage for yourself

Do not hesitate to contact us at 02 080 9195 if you have any question.

Cancer Insurance FAQs

What is a cancer insurance policy?

Cancer insurance is a form of protection for the insured in the event they are diagnosed with a type of cancer, whether it is related to family history or personal habits but excluding pre-existing conditions or cancer symptoms before or during the waiting period. A cancer insurance policy provides a lump-sum payment to the insured which can be used to pay for expenses relating to their medical diagnosis, any lost wages as well as any costs for the cancer treatment.

Why buy a cancer insurance policy?

"Cancer is the Number 1 Cause of Death among Thais for Over 20 Years*"

In addition to the spread of COVID-19 that has created a new fear for people, did you know that cancer is the number 1 cause of death for Thai people over the past 20 years? This is based on information released by the Department of Medical Services, Ministry of Public Health*.

The top 5 most common types of cancer in males are liver cancer and bile duct cancer, lung cancer, colon and rectal cancer, prostate cancer, and lymphoma.

The top 5 most common types of cancer in females are breast cancer, liver cancer and bile duct cancer, cervical cancer, colon and rectal cancer, and lung cancer.

All this, of course, does not mean that you will get cancer, but it is important to know the facts. Assess your own risk level based on your habits, lifestyle and age as well as keep in mind that the financial impact and cost of medical treatment without insurance will be significantly higher.

What does cancer insurance cover?

Almost all types of cancer illnesses will be covered by Roojai policy and at any stage whether critical or non-invasive. Read the details below for the specific cancer care you get with Roojai.

- Any types of cancer at any stage (including malignant melanoma), up to 3,000,000 THB in coverage (depending on the plan)

- Non-invasive cancer and other types of cancer namely:

- Prostate cancer, thyroid cancer, urinary bladder cancer*, chronic lymphocytic leukemia*, malignant melanoma*,

- Any skin cancer, except the melanoma mentioned above, and pre-malignant lesions are excluded.

- Invasive cancer and other types of cancer, namely leukemia, lymphoma, bone-marrow cancer, and choriocarcinoma. The following cancers are excluded:

- Prostate cancer, thyroid cancer, urinary bladder cancer*, chronic lymphocytic leukemia*, non-invasive cancer, carcinoma in situ, any skin cancer (except malignant melanoma), borderline tumour or low malignant potential tumour, pre-malignant lesion*, cancer in a patient infected with HIV or recurrent cancer*

- Non-invasive cancer and other types of cancer namely:

- Skin cancer (except malignant melanoma), up to 200,000 THB in coverage (depending on the plan)

- Hyperkeratoses, basal cell and squamous skin cancer, as well as melanomas*

*please read the full details in the policy wordings.

What is different between cancer insurance and critical illness coverage?

Cancer insurance is often conflated with critical illness insurance. The difference is that cancer insurance focuses on protection from a wide range of cancers instead of other types of diseases that a person may be diagnosed with.

What else is covered by the cancer insurance policy?

If the insured is diagnosed for the first time and confirmed by a Specialist Physician that:

the insured has non-invasive cancer / carcinoma in situ, invasive cancer or skin cancer after the waiting period (90 days) and during the policy period, the company will pay compensation as per the sum insured stated in the insurance policy schedule.

Additionally, you can add-on the Hospital Cash Benefit to your insurance policy and receive salary compensation while you are hospitalised.

How old must the insured be?

18-60 years old (the policy can be renewed continuously until 65 years old)

Where to buy cancer insurance with Roojai?

You can buy your insurance policy online through our website, call 02 080 9195 to talk to our award winning customer service or buy in person at one of our branches

How to buy cancer insurance with Roojai?

- Answer the health questionnaire on our website and get a quote

- Read the details and choose your preferred plan

- Fill out the form, including the start date and the beneficiary

- Pay online and wait for our staff to contact you to confirm your information or wait for the payment confirmation email.

Which payment methods are available?

You can pay for your cancer insurance premium using one of the following methods:

- Credit card or debit card

How much does cancer insurance cost?

We guarantee a fixed premium for 5 years which will be recalculated every 5 years.

Example: If you choose a policy that offers up to 1,000,000 THB of coverage and that policy has an annual insurance premium of 4,200 THB, you will pay a fixed premium of 4,200 THB per year for 5 years.

What are the conditions of the waiting period?

Roojai will not pay compensation if the insured is medically diagnosed with cancer during the first 90 days after the policy start date. The company will refund all the received premium to the insured.

Does the insured need to have a health check-up?

The insured does not need to have a health check-up. Apply easily by just answering a health questionnaire. (If the information provided is found to be inaccurate, Roojai is entitled to increase the insurance premium or terminate the policy.)

Can cancer insurance be deducted on taxes?

Premium payment is eligible for up to 25,000 THB tax deduction, depending on the taxation law.

When does the insurance policy become effective after purchase?

The policy will be effective on the date specified in the policy schedule.

Does this insurance policy cover cancer drugs?

Most cancer insurance policies provide a lump-sum payment when the insured is diagnosed with cancer. The lump-sum payment can be used to pay for any necessary medical treatment to help recover from cancer, including cancer drugs and chemotherapy.

How to renew the cancer insurance policy after 5 years?

The policy can be renewed through the Roojai website. Your premium will be recalculated every 5 years.

How to cancel the insurance policy?

The insured will need to contact Roojai in order to process the policy cancellation:

- In the case of Telemarketing, the policy can be canceled without charges within 30 days (Freelook Period) from the date of receiving the policy.

- In the case of purchase through an online channel, the policy can be canceled without charges within 15 days (Freelook Period) from the date of receiving the policy.

How to contact us?

Customer service 02 080 9195

Terms and Conditions for Cancer Insurance

- Purchase is limited to 1 cancer policy per person.

- You are able to cancel the policy without charges within 30 days (TELEMARKETING) OR within 15 days (ONLINE MARKETING) from the date you receive the policy (Freelook Period).

- You should always read through the details of your coverage and conditions before deciding to buy insurance.

- Roojai will send a receipt and policy documents by mail.

What is NOT Covered by Cancer Insurance? (Coverage Exceptions)

- Critical illness that has been diagnosed, treated, or advised by a physician before the first-year policy start date (Pre-existing condition).

- Critical illness that is diagnosed during the first 90 days after the policy start date specified in the schedule (Waiting Period).

Updated Date 18 December 2024